You’ve just paid your tax bill and now you’ve got a letter from the tax office saying you need to pay more but now it’s quarterly?

They say something about the Pay As You Go Instalment (PAYGI) system, but what is PAYGI? Isn’t PAYG what gets withheld from wages?

The ATO letter says they’ve calculated the amount and you need to pay it quarterly. It seems like a lot, but what is it and why are they sending you this? You just paid your tax bill right?

Don’t worry it’s not just you, unless you know what the instalment system is, this letter doesn’t do a great job of explaining it, but just keep reading and you’ll know exactly what it is, how it works, how much you can expect to pay and when to pay it.

A PAYGI is a payment towards the current financial year’s income tax. You’ve received this letter because you had tax to pay on either business profits or investment income in the last tax return you lodged. The ATO don’t want you to have a big bill at the end of the year, so they get you to pre-pay this year’s tax. Not great for your cash flow, pretty good for theirs though. But on the whole I think the system is required, after all if you’re having trouble paying it quarterly, you’re definitely going to have trouble paying it annually.

Every quarter they’ll send you an activity statement. If you’re registered for GST, it will be on your Business Activity Statement (BAS) as another box. If you’re not registered for GST, they’ll send a PAYG Instalment Notice. It might be by snail mail or via email/electronic depending on your settings with the ATO.

On your first activity statement each year you get to choose which of the 2 methods the ATO will use; the PAYG Instalment amount method, or the PAYG Instalment rate method. Once the method is chosen, you’re stuck with it for the rest of the financial year;

- PAYG Instalment amount

- PAYG Instalment rate

Related Posts

The PAYG Instalment Amount is based on the last tax return lodged and adjusted for growth in the economy using a GDP adjustment factor. In other words they take the tax you had to pay last year and increase it by what the Australian Bureau of Statistics data tells them (The GDP adjustment factor is currently at 5%), then they divide this by the number of quarters left in the financial year.

The Pay As You Go Instalment Rate is a percentage your “instalment income”. Instalment income is basically either your sales or investment income reported in your last tax return.

The percentage is calculated by the tax office, but is basically the tax payable dividend by instalment income in your last tax return. In other words, it’s the percentage of tax on your sales (as opposed to your profit). For example, let’s say you had $27,500 tax last year, taxable income of $100,000 and sales of $1,000,000. Your PAYG Instalment rate would be 27,500/1,000,000 x 100 = 2.75%.

If the amount of tax the tax office wants you to pay is way higher than you will need to pay this year – say your expenses have gone up a lot, or sales have come down. You can vary the amount or the rate to something that is inline with your trading conditions. But if you vary it, and the varied amount is less than 85% of what actually is payable when you do your tax return the ATO can issue you a penalty and general interest charges. This is in place so that everyone doesn’t just vary them to $0, and use the cash (and most likely not have the cash when the tax return is lodged – compounding the tax arrears problem).

Let’s take a look at an example of the 2 methods in action to show how much they can impact your cash flow.

Background. Last year was the first year in business. The tax is $50,000. Sales ex GST was $800,000 (for simplicity we’ll assume they’re evenly spread over each quarter). Taxable income was $181,818.

Your sales will grow 20% year on year.

You lodge the company tax return in August each year.

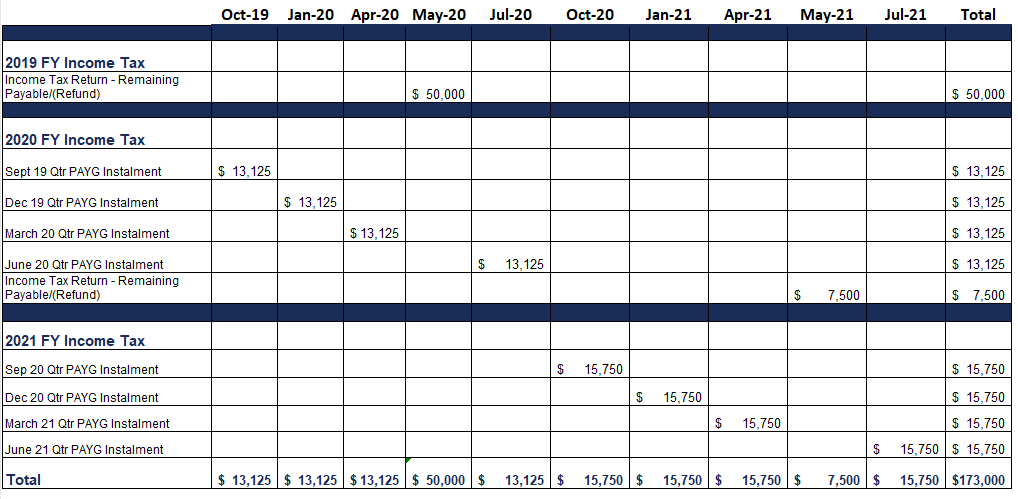

Instalment Amount Method

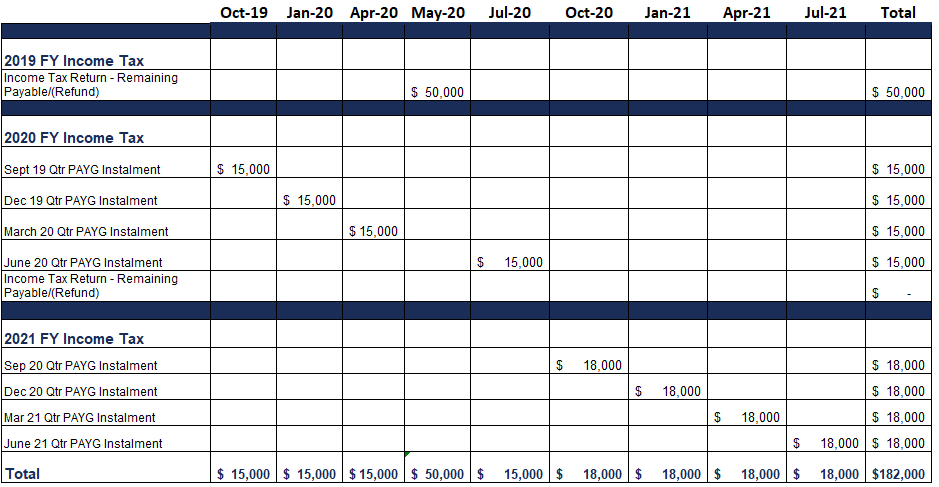

Instalment Rate Method

You Might Also Like

A big factor in your PAYG Instalments is the timing of when you lodge your tax return with the tax office. For most small businesses who are up to date with their taxes and use a registered tax agent to lodge their returns. The due date is generally 15 May in the year after the financial year ends. Let’s look at the tax payments if the return isn’t lodged until May each year.

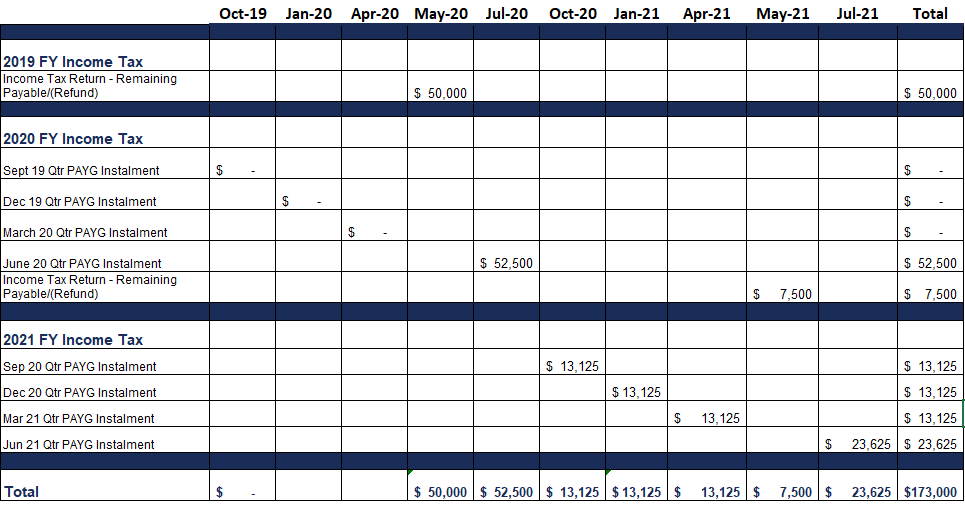

Instalment Amount Method

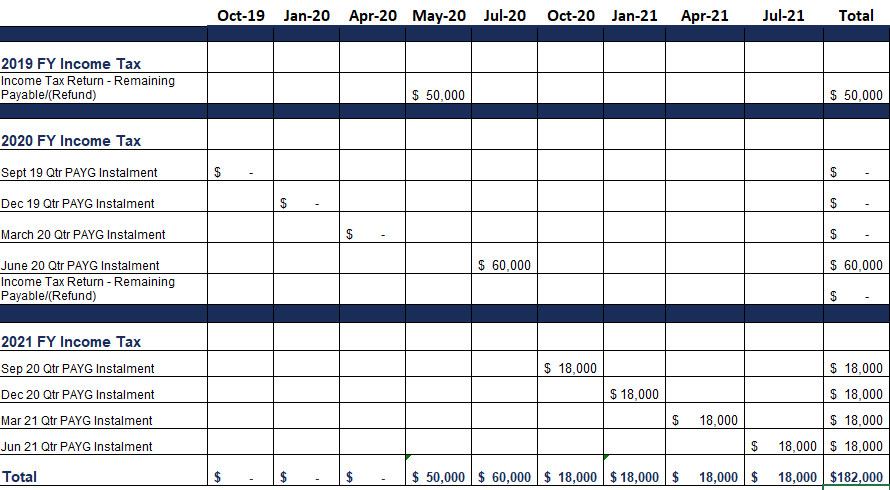

Instalment Rate Method

So there you have it, everything you need to know about PAYG Income Tax Instalments, how they work, what the different methods can mean for your business, and the timing of lodging your tax return has on cash flow. Neither method or timing is right or wrong, it just comes down to personal preference and your ability to manage (save) cash for these payments.

Are you an early tax lodger or late? Let me know!