Property development is without doubt the most popular thing people want to do to make money that I’ve heard in my advisory career.

The conversation usually goes like this;

Me: So you’re a Doctor, Lawyer, Engineer, Dentist, Graphic Designer, (insert any occupation here) how’s business?

Client: Yeah it’s good, really busy at the moment…. I’m going to do some property developments.

Me: Oh right, so have you got any experience in that?

Client: No, but I know this guy who made heaps. He just split the block and built a place & sold them.

Me: (inaudible) ffs…

Me….ok, well have you done the feasibility calculations?

Client: yep, $x for the property, a few grand to move it/knock it down, a few grand for council fees & then $x to build a house so I should make like 40% return.

Me: …….and what about interest, transfer duty, legals, accounting, agents fees, tax, & GST?

Client: my mate’s accountant said it was tax free.

Me……..(audible) ffs

Let’s clear this up right now shall we?

The actual answer, like anything in tax is, it depends.

There is no rule that says, you can do the first one tax and/or GST free, so let’s go (briefly) through the issues. This is by no means a comprehensive answer, but hopefully it gives you enough to worry about to actually pay for some proper advice, by a proper advisor, like umm, us.

Some people have this idea to “make it my main residence” and then sell it tax free.

Ok, sometimes that actually is the truth, live on a big property that can be subdivided? Actually move into the property and make it your home (no, there is no time limit on this. But just have common sense – the ATO aren’t idiots)? Then yeah, there is a possibility you’ll get some main residence exemption.

Putting the main residence “strategy” aside. The big issue with income tax is whether it’s a capital gains tax event or ordinary income. Unfortunately there is no black and white answer, rather, there are numerous factors the ATO (and the courts) apply the facts of the case to, to decide. With that, I hope you’ve got a big drink, because this is going to get a bit dry;

In tax world there is a big distinction between “profit making intention” (ordinary income) versus “mere realisation of an asset” (capital gains) due to their different taxation treatments.

Taxation Ruing 92/3 – Income Tax: whether profits on isolated transactions are income; provides guidance on the ATO’s position.

The over-riding theme of this ruling is whether the transaction was entered into with a profit-making purpose. Profit making does not need to be the dominant or sole purpose of entering into a transaction, only that profit-making was a significant purpose.

Some factors that the ATO looks for in determining this purpose are;

- The intention of the taxpayer in entering into the transaction was to make a profit

- The timing of the transaction or the various steps in the transaction

- Your use of property during that time

- Whether you conducted yourself in a business like manner

An example might help. Let’s say you buy a block of land, its 1200m2 with one house on it, as soon as you settle you submit your DA application to subdivide it into 3 blocks. You move the house to one side, give it a lick of paint, tart up the kitchen and bathrooms, stick some bark on the front gardens, and then stick for sale signs on all 3 blocks.

If I was a lucky eight ball I’d be saying “all signs point to profit making intention”.

Compare the above to this: You bought a 1200m2 property with a house on it, you rented it out for 10 years, now that you’re married and had some rug rats you need some cash to send them off to boarding school, so you get a DA move the house to the side and subdivide it. You sell all 3 properties.

Shake me again and I’d say “mere realisation is more probable”

You might be thinking if you’re a small developer and that you are not in business, you’re just doing this one subdivision, but that, I’m sorry, doesn’t absolve all the factors to be considered, it is only one of the areas. There was a court case waaayyyy back in the day that is the prevalent ruling on this, “The Myer Emporium Case”, where they consider whether an isolated transaction can be income (ordinary income) rather than a lump sum (capital gain).

I know you’re desperate to read that, but for the sake of brevity, the answer is yes, yes it can. So your one off development can in fact still be conducted with a profit making intention and in a business like manner. Depending on the other facts of your development, this could weigh you into the ordinary income category.

So what? I hear you ask.

Good question.

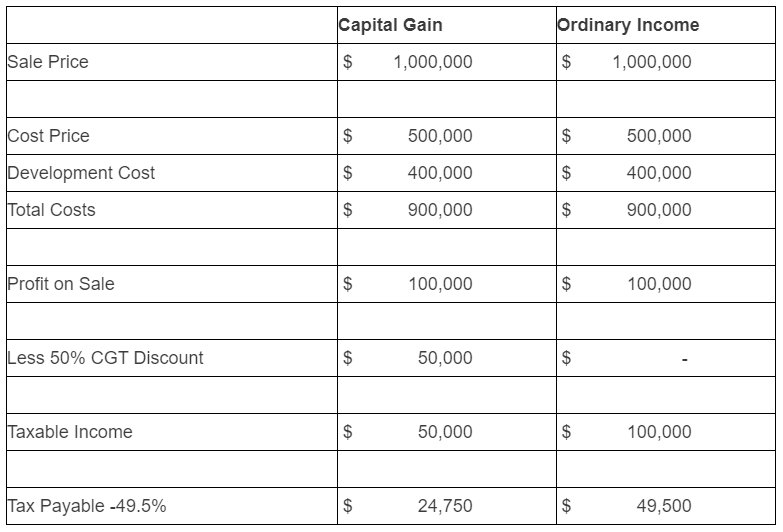

The big concession people are always chasing (other than main residence exemption) is the 50% capital gains tax discount on assets owned for more than 12 months (FYI, the pertinent dates are the contract dates, not the settlement dates for capital gains purposes). Maybe this is best depicted with numbers (yay! numbers).

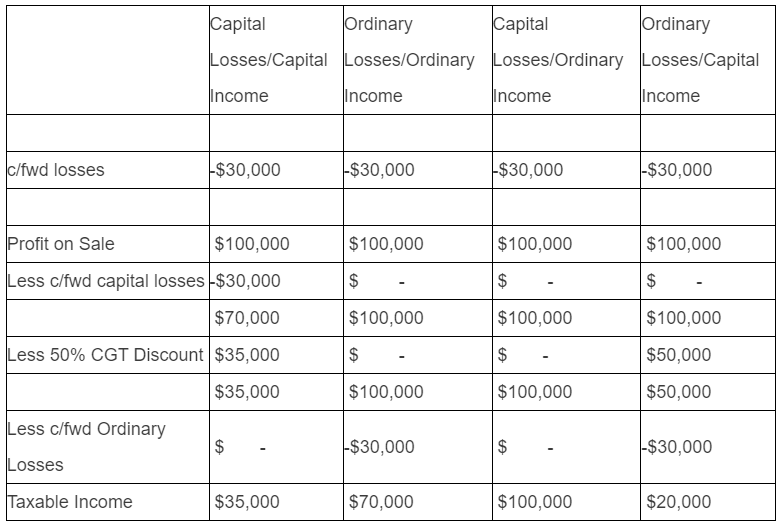

The factor that people don’t consider though, is the potential for losses (because Nathan, you can’t lose money on property) and the use of carry forward losses. In summary capital losses can only be applied against capital gains (and the before discount gain at that), so if you have ordinary income, and carry forward capital losses, in technical terms you’re shit out of luck.

However, if you had ordinary income losses and a capital gain, you can offset the ordinary income loss from the net capital gain (net = after you have applied capital losses & any discounts available). This is about as good as it gets with applying losses by the way. Clear as mud? This might help;

So there you have it, the briefest guide to income tax on small property developments.

But wait there is more. How’s that drink going? You might want to take another swig.

GST may apply to your little venture if you are considered to be carrying on an enterprise” for the purposes of GST and you are selling new residential property (this includes vacant subdivided land, and existing houses that have been renovated/extended until there is more new house than existing house).

The term enterprise is defined in s9-20 of the GST Act, and the relevant clauses included below;

An enterprise is an activity, or series of activities, done:

(a) in the form of a * business; or

(b) in the form of an adventure or concern in the nature of trade; or

(c) on a regular or continuous basis, in the form of a lease, licence or other grant of an interest in property;

As parliament made this definition intentionally broad, the ATO released a tax ruling MT 2006/1 to help everyone make sense of it and clarify their position (aka If you don’t do it that way, be ready for a fight) and provide a number of examples of common scenarios.

One such example “isolated transactions and sales of real property” is particularly pertinent to small scale developments. Specifically paragraph 270 of MT 2006/1 states;

“In isolated transactions, where land is sold that was purchased with the intention of resale at a profit (Watson & Watt: which would be ordinary income) the Commissioner considers these activities to be an enterprise. This would be so whether the land was sold as it was when it was purchased or whether it was subdivided before sale. An enterprise would be carried on in this situation because the activities are business activities or activities in the conduct of a profit making undertaking or scheme and therefore an adventure or concern in the nature of trade.”

Based on this stated position of the ATO, you can easily be drawn into the GST system on your development. Excellent I hear you say, there goes 1/11th of my sale price. Well, not so fast champ. There is some good news.

Being an “enterprise” will require you to register for GST before a contract of sale is entered into.

Once registered you are able to claim GST on any expenses related to the subdivision and sale of the land. Contrasting this, you will also be required to charge and withhold GST on the sale of the land, but you may however be eligible for the GST Margin Scheme. Note though that the renovation and sale of existing residential dwelling is Input Taxed, meaning no GST is claimable on the expenses and no GST is payable on sale.

Still with me? One last gulp. Here. We. Go.

The Margin Scheme allows eligible entities to calculate and pay GST in a different manner than the standard calculation. For property purchased after 1 July 2000 the calculation is;

1/11th of the sale price – purchase price

That is, you only pay GST on the margin between your sale price and your acquisition cost.

You are eligible for the Margin Scheme on property you purchased after 1 July 2000 if one of the following applies to the person who sold you the property;

- They were not registered or required to be registered for GST

- They sold you existing residential premises

- They sold the property to you as part of a GST-free going concern or GST-free farmland, and were eligible to use the margin scheme

- They sold you the property using the margin scheme.

The benefit of the Margin Scheme is that you get to “claim” the GST on the purchase of the property as if the seller was registered for GST at that time, even though they actually weren’t.

In order to use this scheme, you must be registered for GST and have a written agreement with the purchaser, before settlement date to sell the property under the Margin Scheme. This agreement is usually contained in the contract for sale, with a specific clause that the contract and sale is being conducted under the Margin Scheme. You will need to instruct your solicitor when preparing the documents that you wish to use the Margin Scheme and for them to include the relevant clauses into each contract.

If you don’t have these items satisfied, you won’t be eligible to use the Margin Scheme and you’d be up for GST equal to 1/11th of the sale price (ouch).

So if this article has proven anything. Drinking helps us get through tax legislation and developments no matter how small, have complex tax implications.

Still want to listen to your mate’s accountant?