Both a redraw and an offset account will reduce the interest you pay on a loan. Any amounts you deposit into these are taken into account when the lender calculates the interest. In effect they are reducing the amount you owe, then multiplying that by the daily interest rate.

But in practice these accounts works slightly differently;

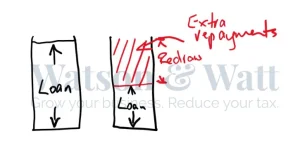

Redraw Facility

A redraw facility is a feature of a loan. It’s not an account separate to the loan.

With a redraw the lender allows you to “redraw” any extra payments over and above the minimum you have made. These extra amounts reduce the loan balance, and therefore reduce the interest paid.

Some loans, like fixed rate loans have limits of how much per year you can contribute over the minimum – and some have limits on how much or how often you can redraw. In essence redraw is really for amounts that you don’t want to pull out very often.

From a tax perspective, every redraw you make constitutes a new, and separate loan. What you apply those redrawn funds to, then determines whether or not the interest is deductible or not.

This isn’t a problem when you’re redrawing to pay the personal credit card, buy a car, or do up the bathroom. All that stuff isn’t income generating, therefore the interest isn’t tax deductible. So using a redraw here is fine. But it may not work out too well in some circumstances.

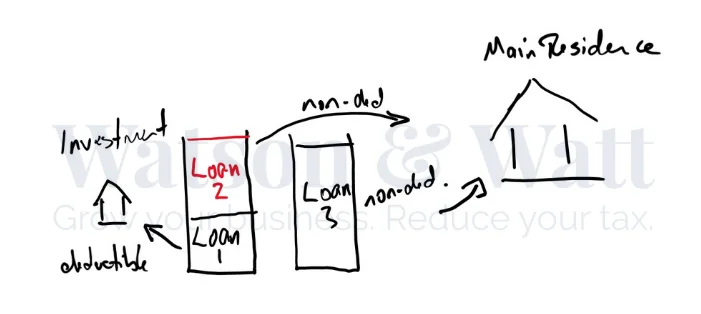

Example | Turning your current house into an investment property

Let’s assume you’ve got a house and a mortgage with a redraw facility. You’ve been making extra repayments each week so you’re ahead on your loan. You’ve had a couple of kids, 2 dogs, 3 budgies and a fish and need a bigger house. You think the current house is still a good asset, and want to hold onto it and turn it into an investment property.

You’ve been diligent and have quite a bit squirreled away and can redraw enough from your current mortgage to fund the deposit on the new house to live in. Wonderful you do just that and then get another loan for the balance of your new house. Your loan positions would look like this from a tax perspective;

In tax land you now have 3 loans – even though in your internet banking you’ve only got 2. Loan 1, has now been split into two separate facilities from tax perspective, the original loan purpose stays – to purchase the first house, which you’ve now turned into an investment property. If the property is rented or available for rent, the interest on that debt becomes tax deductible.

The amount you redrew to fund the deposit on the new house is a separate loan for tax purposes, and the use of those funds is non-deductible (to buy your new main residence).

So your original loan now has two purposes and has become what is known in the biz as a “mixed use loan”. You’re going to need an accountant to help with the calculation of what is then deductible interest and non-deductible becomes a bit of a PIA and thank sweet baby Jesus for excel – because each repayment you make towards the loan needs to be split between deductible and non-deductible. Expect to pay a bit more in accounting fees now.

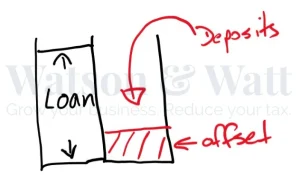

An offset account, unlike a redraw is a separate account. They have their own account number, and generally can have debit cards attached to them. You can have your wage deposited into it, and direct debits come out of it. They are in all ways, just another transaction account. They are designed to have regular deposits and withdrawals – unlike a redraw facility.

The key difference between these and your Dollarmite account is that the balance of your offset account is subtracted from your loan balance before the lender calculates the interest.

From a tax perspective the loan account hasn’t changed, and the amount you withdraw from the offset hasn’t created a new loan – because the funds haven’t come from a loan. You’ve just withdrawn funds from a bank account.

The deductibility of the interest on the loan is determined by the purpose the loan was used for. In example above this was to purchase the property.

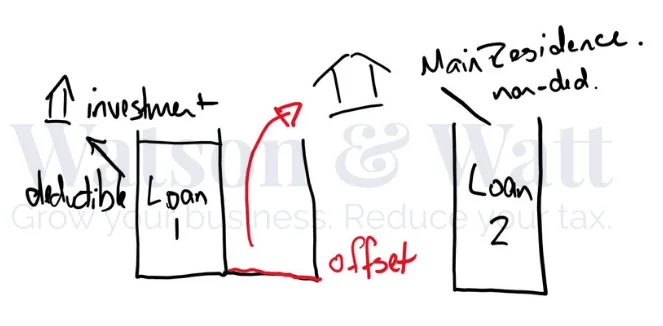

Example | Using an Offset Account

Same scenario as the previous example, but this time you’ve been using an offset account instead of a redraw facility.

You have the same amount of loan, and the same amount in the offset account. You empty the offset account for the deposit on your new digs. Then get another loan for the rest. Same same right? Not when we do your tax return.

Loan 1 balance is larger, and the purpose of that loan was to buy the first house, which is now income producing. The interest on this loan is now entirely deductible, this will reduce the amount of tax you pay.

Loan 2 is non-deductible as the use of that was a house you are living in – so it is not income producing.

So your end debt, repayments and rent received are identical under these two structures, it is just that using an offset account has resulted in you paying less tax by having larger tax deductible interest component.

Offset accounts can provide greater flexibility because you don’t always know if you’re going to turn your current house into a rental, or what will happen in the future.

With an offset account you retain the option – if it was to be beneficial (and allowed under your loan terms), to transfer the funds from the offset to the loan, and then redraw it and create a separate loan for tax purposes.

A word of caution though. Offset accounts aren’t always “free”. Some loan packages charge a higher interest rate to give you an offset account. So you need to be satisfied that the interest savings are worth it to pay a higher interest rate. Many lender’s don’t charge for an offset account however – so it’s worth looking around (or contacting a mortgage broker – like us to do it for you).

Offset accounts and redraw facilities provide similar functionality in reducing the amount of interest paid on a loan. But there are key differences to take into account when deciding which one to use.

Offset accounts are a transaction account for regular deposits and withdrawals and provide greater flexibility into the future, but sometimes come at a cost. If you’re not in a position to dump extra repayments into your loan, then the benefits may not be there.

Having redraw functionality is great – but be careful how you use it. Getting it wrong can cost you thousands in lost tax savings in some situations. Ideally you get both an offset account and a redraw facility so you’re prepared for what comes your way – but never pay extra for something you may not need.