Having a hard time remembering when stuff is due?

You’ve got a lot to do in business and if your accountant isn’t reminding you, it’s easy to forget the heap of things you’ve got to submit as the tax office middle man. But late lodgement is one of the 4 common mistakes small business makes with the ATO, so bookmark this page it’s got your BAS due dates for quarterly and monthly reporting cycles.

When is my Business Activity Statement (BAS) due?

If you’re on a quarterly reporting cycle your BAS due dates for 2025 are

|

QUARTER |

Electronic Lodgement |

|

|---|---|---|

|

January – March 2025 |

26 May 2025 |

|

|

April – June 2025 |

25 August 2025 |

|

|

July – September |

25 November 2025 |

|

|

October – December 2025 |

28 February 2026 |

|

If you are on a monthly cycle your BAS due dates for 2025 are

|

MONTH |

BAS DUE DATE |

MONTH |

BAS DUE DATE |

|---|---|---|---|

|

January 2025 |

21 February 2025 |

July 2025 |

21 August 2025 |

|

February 2025 |

21 March 2025 |

August 2025 |

21 September 2025 |

|

March 2025 |

21 April 2025 |

September 2025 |

21 October 2025 |

|

April 2025 |

21 May 2025 |

October 2025 |

21 November 2025 |

|

May 2025 |

21 June 2025 |

November 2025 |

21 December 2025 |

|

June 2025 |

21 July 2025 |

December 2025 |

21 January 2025 |

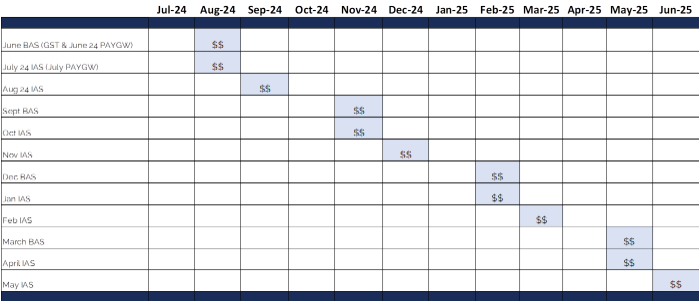

This is where it gets a little tricky. If you have employees and withhold more than $20,000 per year from their wages in pay as you go withholding (paygw), you should be on a monthly reporting cycle. This cycle is independent of your GST reporting cycle. Most businesses pay GST on a quarterly basis and PAYGW on a monthly basis.

This means you will receive an Instalment Activity Statement (IAS) for the first two months of each quarter then, get a BAS for the last month. Confused? This should help;

|

MONTH |

Due Date |

GST Period |

PAYGW PERIOD |

PAYGI PERIOD |

|---|---|---|---|---|

|

January 2025 |

21 Feb 2025 |

n/a |

January |

n/a |

|

February 2025 |

21 March 2025 |

n/a |

February |

n/a |

|

March 2025 |

26 May 2025 |

Jan to March |

March |

Jan to March |

|

April 2025 |

21 May 2025 |

n/a |

April |

n/a |

|

May 2025 |

21 June 2025 |

n/a |

May |

n/a |

|

June 2025 |

25 Aug 2025 |

Apr to Jun |

June |

Apr to Jun |

|

July 2025 |

21 Aug 2025 |

n/a |

July |

n/a |

|

August 2025 |

21 Sep 2025 |

n/a |

August |

n/a |

|

September 2025 |

25 Nov 2025 |

Jul to Sep |

September |

Jul to Sep |

|

October 2025 |

21 Nov 2025 |

n/a |

October |

n/a |

|

November 2025 |

21 Dec 2025 |

n/a |

November |

n/a |

|

December 2025 |

28 Feb 2026 |

Oct to Dec |

December |

Oct to Dec |

What happens if you lodge your BAS late?

Late lodgement can result in the ATO issuing a failure to lodge on time penalty (FTL). These penalties depend on the size of your business and range from $313 to $1,565 per late lodgement for most businesses (for “significant global entities” they can be $156,000 !). So if you don’t lodge 4 x BAS on time, you could be up for $6,260 in penalties (which are not tax deductible)!

What if you can’t pay your BAS on time?

If you can’t pay your BAS on time, you still need to lodge it with the ATO on time. This will stop them issuing the failure to lodge penalties. It is also important when it comes to director penalty notices.

Payment plans can be negotiated with the ATO. For debts under $200,000 and businesses with a generally good lodgement history, you can organise them online.

For larger debts and/or businesses with a history of payment plans (and defaulted payment plans) you may need to call them and speak to a real life person. Keep in mind the ATO charge interest on overdue debts.

If you have difficulty in paying your BAS on a regular basis you have a cash flow problem that needs a solution fast.

Not being able to pay your BAS is a first sign that your business needs help. If that’s you. Get in touch

Submitting and paying your BAS on time isn’t just good corporate citizenship, it can stop you from becoming personally liable for debts of the business, and it reduces the Tax Office risk assessment of your business. So now you know the BAS due dates, make sure you submit and pay on time. If you need a hand, let us know. We prepare and lodge BAS as part of our tax and accounting services.